Could it be time for some cautious optimism following the latest wave of financial information out of the office of national statistics and other leading providers of financial data?

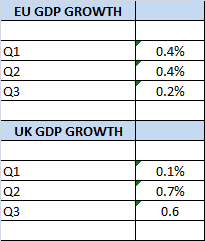

It seems that UK Growth seems to be continuing its bounce back from a poor first quarter even in the face of the halving of growth across the EU. In July the Eurozone reduced their forecast but it seems the actual Q3 numbers are lower than revised number produced by the commission in July. EU growth is now at its weakest point in 4 years to 0.2%.

Meanwhile the UK seems to be having something of a resurgence in the face of problems in the Eurozone and the Brexit process. Of course, this is far from the full story, but it is encouraging for the British nonetheless. Yet one has to remember that the entire EU including Britain is extremely sluggish and we are essentially comparing failure, with a bit less failure. However, there are signs of hope for Britain, particularly if the estimated Q3 growth figure also goes above the expectation as it did in Q2. Could we see a 0.7 or even 0.8 at the final count? The clearest example yet that Britain’s ‘Brexit’ is well founded.

The Q3 figure for the UK is based on the current estimates as the final figures are not quite published yet. Those are due on the 9th November. The estimates range between 0.5% and 0.7% from the most popular sources. However, Q2 performance came in above most estimates and there is a strong sense that this may well be the case again. It is interesting that those early, encouraging green shoots of EU growth, continue to wither away. While the UK seems to be fairing somewhat better than expected, even during what one would call’ poor economic weather. For ‘weather’ read, bad publicity thanks to mainstream media propogandists, a weak Prime Minister and the best efforts of the EU to denegrate the UK.

This very much seems to be born out in discussions with many business leaders from global companies. Many of whom have been through almost a decade of restructuring EU operations against political and Eurozone risk following the crisis in the Eurozone and are now looking to see if Britain will leave the EU to become a truly free market country in the true sense of the word.

Britain is likely to see a slowdown in inward investment in the run up to Britain actually leaving the EU. Very likely followed by a real surge should Britain manage to fully exit the zone of EU control and achieve trading independance as a sovereign entity once more.